How an Offshore Trust Supports Multi-Jurisdictional Wealth Management

How an Offshore Trust Supports Multi-Jurisdictional Wealth Management

Blog Article

Why People and Companies Consider an Offshore Trust for Tax Performance

Numerous people and services transform to overseas trust funds as a method for tax obligation efficiency. These depends on offer distinct benefits, such as prospective deferment of revenue taxes and reduced prices in favorable jurisdictions. By positioning assets within these depends on, customers can successfully minimize resources gains and inheritance tax obligations. However, the benefits expand past simply tax obligation financial savings. Recognizing the more comprehensive ramifications of overseas trusts reveals a complicated monetary landscape that qualities further expedition.

Comprehending Offshore Trusts: Interpretation and Objective

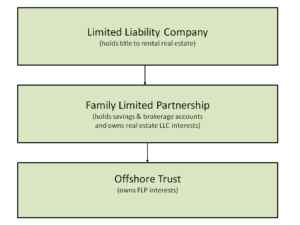

Offshore depends on act as specialized financial tools made to take care of and shield assets while optimizing tax efficiency. These legal structures are developed in territories outside the person's nation of house, frequently providing beneficial tax routines and personal privacy securities. The main function of an overseas count on is to set apart properties from the individual's individual estate, consequently promoting critical monetary planning. By placing assets in a trust, individuals can possibly minimize their general tax concern while making sure that their riches is preserved for future generations. In addition, offshore trusts give versatility concerning possession management and circulation, enabling trustees to adapt to transforming situations. They can be particularly advantageous for high-net-worth individuals and family members seeking to guard their riches against possible dangers, such as market volatility or legal obstacles. Eventually, comprehending overseas trusts is necessary for anyone considering them as a tool for tax obligation performance.

Advantages of Offshore Trusts for Asset Security

One significant benefit of making use of trusts established in foreign jurisdictions hinges on their capability to give durable possession defense. Offshore trusts are typically structured to secure possessions from possible creditors or legal insurance claims, developing a barrier that can deter legal actions and economic responsibilities. This protection is especially beneficial for individuals in high-risk occupations or entrepreneur encountering litigation.Additionally, the lawful frameworks of several offshore territories provide positive problems, consisting of solid privacy laws that protect the identity of count on beneficiaries and their possessions. This privacy can additionally boost safety and security against unwanted scrutiny. The splitting up of properties from individual holdings indicates that, in the event of insolvency or divorce, the assets within the overseas trust fund are much less susceptible to being seized. Overall, the strategic establishment of overseas counts on acts as a valuable device for those seeking to safeguard their wide range from unexpected risks.

Tax Effectiveness: How Offshore Trusts Decrease Tax Obligation Responsibilities

Offshore depends on use considerable tax obligation advantages that can help services and people minimize their tax responsibilities. By purposefully positioning possessions in these trust funds, one can likewise enhance property protection strategies, securing wide range from prospective lenders and lawful obstacles. Comprehending these mechanisms is crucial for maximizing monetary effectiveness and protection.

Tax Benefits Introduction

While lots of individuals seek ways to optimize their monetary techniques, utilizing offshore depends on has actually become a compelling choice for decreasing tax obligation liabilities. Offshore counts on supply several tax benefits that can substantially enhance financial efficiency. One main benefit is the capacity for tax deferral, permitting people to hold off tax obligation payments on income produced within the depend on till it is dispersed. In addition, these trust funds might provide accessibility to reduced tax obligation prices or exemptions in certain jurisdictions, additionally minimizing general tax obligation problems. By tactically positioning properties in an overseas trust fund, businesses and people can leverage beneficial tax laws to make the most of wealth preservation. Ultimately, the tax obligation benefits of offshore trust funds make them an appealing selection for those aiming to enhance financial results.

Possession Protection Strategies

Making use of overseas depends on not only offers considerable tax benefits however likewise functions as a durable technique for property defense. These depends on can shield properties from potential lenders, legal cases, and unanticipated monetary difficulties. By placing possessions in an overseas count on, services and people can develop an obstacle against residential suits and claims, making it extra tough for creditors to gain access to these sources. In addition, the confidentiality connected with overseas counts on can better enhance security, as it limits open secret of possession holdings. Diversifying possessions across territories also alleviates risks connected with financial instability in any single nation. In general, overseas trusts represent a critical method to securing wealth while simultaneously optimizing tax performance.

Estate Preparation and Sequence: The Function of Offshore Trusts

Estate planning and sequence are vital components of economic administration, specifically for individuals with significant properties. Offshore depends on work as a tactical device in this process, permitting people to handle their wealth throughout boundaries while ensuring a smooth transfer of possessions to recipients. By establishing an offshore trust, people can dictate the terms of possession circulation, thereby minimizing prospective disagreements among heirs.Additionally, overseas trust funds can assist minimize inheritance tax, depending upon the lawful structures of the territory involved. They supply an organized method to taking care of wide range, ensuring that assets are safeguarded and assigned according to the grantor's dreams. This is specifically useful for those with facility family dynamics or different asset types, as the trust fund can accommodate particular directions pertaining to the management and distribution of assets.

Privacy and Privacy: Guarding Your Financial Information

Governing Considerations and Compliance Issues

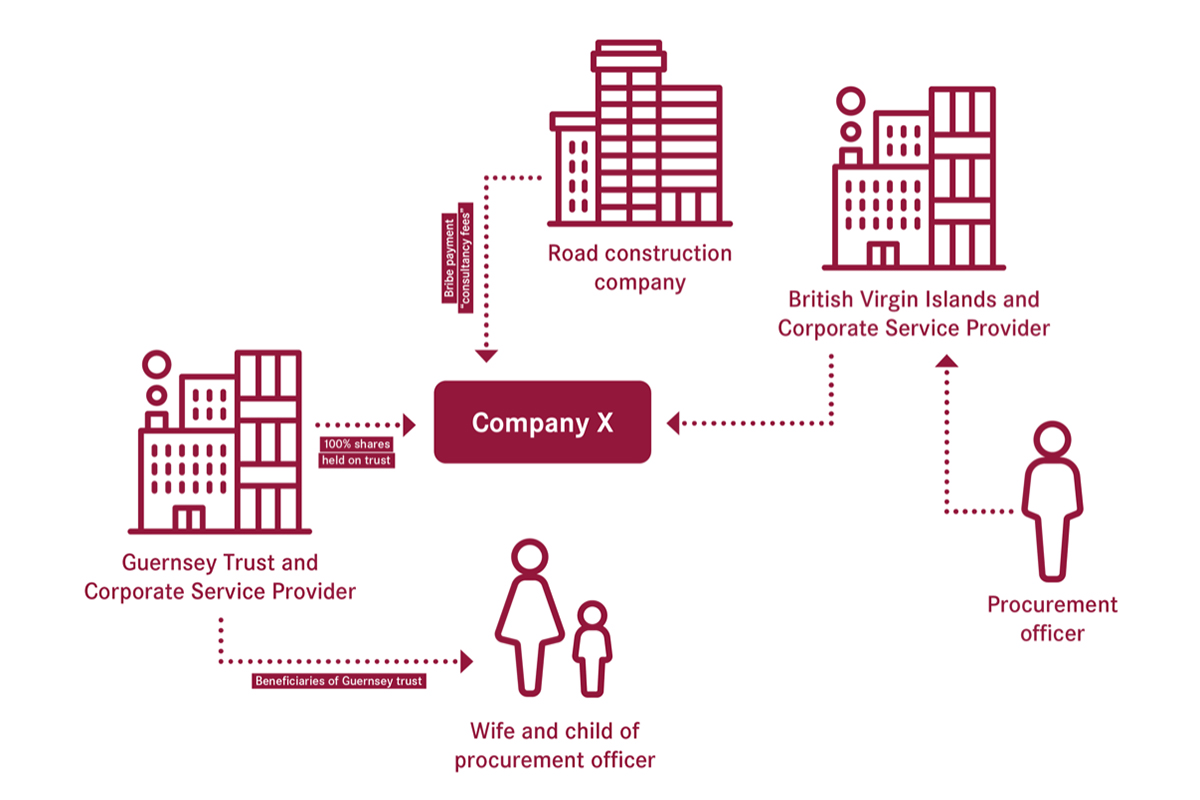

While offshore counts on offer substantial privacy advantages, they likewise feature a complex landscape of governing considerations and conformity concerns that should be browsed very carefully. Territories that provide offshore trust funds typically have details laws regulating their facility and management. The pop over to this web-site Foreign Account Tax Compliance Act (FATCA) mandates U.S (Offshore Trust). people to divulge international monetary possessions, elevating compliance concerns for depend on owners. Additionally, numerous countries have actually implemented anti-money laundering (AML) guidelines that require due diligence and transparency in depend on procedures. Failing to abide by these laws can lead to serious charges, including fines wikipedia reference and legal repercussions. It is necessary for people and businesses to engage legal and monetary professionals who are familiar with both regional and worldwide legislations to ensure conformity. As a result, while the benefits of offshore counts on are appealing, the connected regulative intricacies require cautious planning and professional guidance

Selecting the Right Offshore Jurisdiction for Your Trust

Picking the appropriate overseas jurisdiction for a depend on involves careful consideration of the legal framework's security and the tax obligation rewards available. A territory with a durable and trusted lawful system can offer greater protection and satisfaction for count on creators. In addition, comprehending the certain tax benefits supplied by different regions is essential for making the most of the trust's performance.

Legal Structure Security

Choosing the ideal overseas jurisdiction for a depend on calls for careful factor to consider of the lawful framework security, which greatly affects the trust's long-lasting efficiency and safety. A stable legal setting ensures that the trust fund will be safeguarded versus approximate adjustments in laws or guidelines that can undermine its function. Territories recognized for solid lawful traditions, robust judicial systems, and adherence to global treaties are frequently chosen, as they supply a feeling of integrity for trust settlers and beneficiaries. Additionally, clarity in the lawful framework helps decrease the danger of conflicts and improves depend on management. People and organizations must conduct complete study to recognize territories that not just use stability however are additionally trusted and appreciated in worldwide monetary circles.

Tax Rewards Provided

What tax rewards can enhance the effectiveness of an overseas trust fund? Numerous territories use certain tax benefits that can greatly enhance the monetary effectiveness of these counts on. Some areas supply zero or reduced funding gains tax obligations, permitting assets to grow without the worry of tax until they are distributed. Additionally, specific jurisdictions might excuse offshore trust funds from inheritance or inheritance tax, guaranteeing that wide range is preserved for beneficiaries. Other rewards include positive tax rates on revenue generated within the trust fund or favoritism for foreign-sourced earnings. Customers must carefully assess the tax obligation rewards of possible jurisdictions to straighten their monetary objectives with the legal benefits offered, enhancing the overall advantages of their overseas depend on setups.

Frequently Asked Inquiries

Are Offshore Trusts Legal and Compliant With Tax Obligation Laws?

Offshore depends on are lawful entities that can adhere to tax legislations, given they comply with guidelines in both the host nation and the individual's resident country. Nonetheless, their legality often depends upon details circumstances and intents.

How Do I Establish an Offshore Count on?

To establish an overseas depend on, one have to pick a territory, choose a trustee, fund the trust with assets, prepare a trust fund act, and warranty conformity with lawful needs, consisting of tax obligation commitments, in both home and overseas areas. Offshore Trust.

What Are the Prices Connected With Keeping an Offshore Trust?

Keeping an offshore count on involves several costs, including setup charges, annual management charges, legal and bookkeeping costs, and prospective taxation on income. These expenses can differ considerably based upon territory and the intricacy of the depend on framework.

Can Offshore Trusts Protect Possessions From Creditors?

Offshore trusts can possibly secure assets from lenders by positioning them past the reach of domestic legal claims. The efficiency of this security varies based on territory and certain legal conditions surrounding each case.

Just how Do I Select a Trustee for My Offshore Depend on?

Selecting a trustee for an offshore depend on involves evaluating their experience, online reputation, and understanding of relevant legislations. It is essential to assure they have honesty and a dedication to acting in the most effective passions of the trust fund. Offshore counts on serve as specialized monetary tools have a peek at this site developed to take care of and safeguard properties while optimizing tax obligation performance. Offshore counts on supply significant tax benefits that can aid people and services lessen their tax obligation liabilities. By purposefully putting properties in an overseas trust, businesses and individuals can take advantage of beneficial tax obligation regulations to maximize wealth preservation. By developing an overseas trust fund, people can dictate the terms of asset circulation, thereby reducing prospective disagreements amongst heirs.Additionally, overseas trust funds can help mitigate estate taxes, depending on the legal structures of the jurisdiction included. Selecting the ideal overseas territory for a depend on calls for mindful factor to consider of the lawful framework security, which considerably influences the trust fund's lasting performance and protection.

Report this page